when will estate tax exemption sunset

Estate Tax Exemption. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

No Need To Fear A Federal Claw Back Twomey Latham

Because the exclusion amount is back to 115 million your estate tax is 46 million.

. Significant Changes Regarding Estate Tax. One of the biggest changes well see with the tax rates sunsetting in 2026 involves the estate tax. The estate tax due would be zero.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. The federal estate tax exemption is set to sunset at the end of 2025. The sunset of the estate and gift exemption will have a.

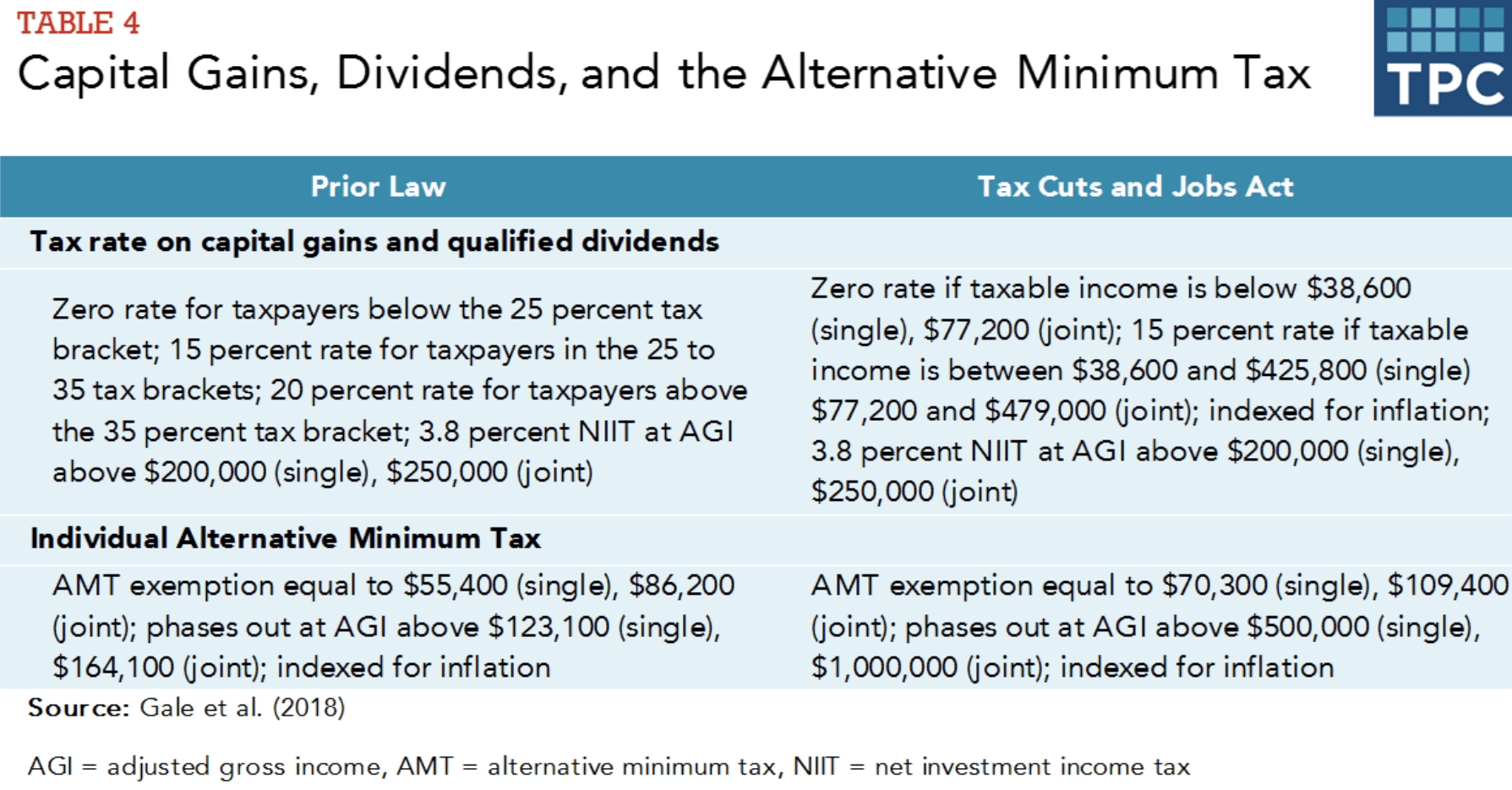

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. This means that to produce an estate tax advantage pre-sunset gifts must be greater in value than the post-sunset exemption amount and the post-sunset exemption may. At a tax rate of 40 thats a 72 million tax bill.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. Starting January 1 2026 the exemption will return to 549 million.

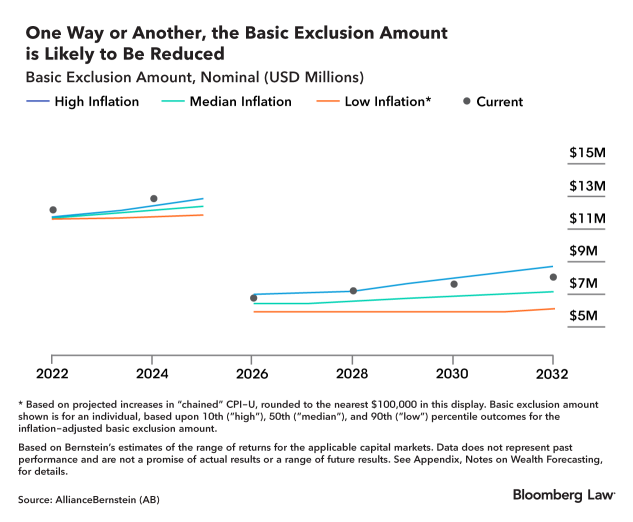

The estate planning environment has changed over the last decade. TCJA doubled the estate and gift tax exemption to 112 million for single filers 224. In 2026 the estate and gift exemption will revert back to pre-TCJA levels effectively reduced by half and expected to be in the ballpark of 65 million per individual or 13 million for a married couple.

The current 1206 million estate tax. We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable. In this case on Jan.

1 2026 the estate tax exemption is set to drop back to what it was before 2018. As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued final regulations confirming that individuals taking. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. This sunset raises the. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

After 2025 the exemption amount will sunset a fancy way of. For many boomers the sunset of the current estate and gift tax provisions provides the greatest gloom. Fast-forward to 2026 and the estate and gift tax exemption.

Notably the TCJA provision that doubled the gift. Unless your estate planning is. Fast-forward to 2026 and the estate and gift tax exemption.

Currently the estate tax. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified. After that the exemption amount will drop back down to the prior laws 5 million cap.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption.

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. However the TCJA will sunset.

5 million adjusted for inflation. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset. However the TCJA will sunset.

Unless Congress acts in the interim for those dying in 2026 or later the threshold will be 68 million adjusted for inflation between now and then.

The Generation Skipping Transfer Tax A Quick Guide

Estate Tax Exemption For 2023 Kiplinger

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Federal Estate Tax Exemption Is Set To Expire Are You Prepared The Hayes Law Firm

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

A New Era In Death And Estate Taxes

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

Final Tax Bill Includes Huge Estate Tax Win For The Rich The 22 4 Million Exemption

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Estate Tax Planning Tips For Single People Sol Schwartz

Irs Bumps Up Estate Tax Exclusion To 12 92 Million For 2023

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea

Estate Taxes Under Biden Administration May See Changes

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 How Much It Is And How To Calculate It

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Beyond Federal Tax Reform A Guide For Minnesota Estate Tax Planning Ds B